foreign gift tax return

Person receives a gift from a foreign personThat. IRS Form 3520 is required if you receive more than 100000 from a nonresident alien or a foreign estate.

.jpg)

Us Taxation How To Report Inheritance Received On Your Tax Returns

The gift tax is a tax on the transfer of property by one individual to another while receiving nothing or less than full value in return.

. The IRS will provide a copy of a gift tax return or the gift tax return transcript when Form 4506 or Form 4506-T is properly completed and submitted with substantiation and. Individual Tax Return Form 1040 Instructions. Taxpayer receives a gift from a foreign person trigger an international tax filing requirement.

American expatriates are subject to gifts tax reporting requirements on US expat tax returns if the aggregate value of foreign gifts exceeds 100000. Even though there are no US. Person or a foreign person or if the giftproperty is in the US.

Certain events such as when a US. Form 3520 is an information return not a tax return because. According to the IRS if you are a nonresident alien who made a gift subject to the foreign gift.

The IRS Reporting of International Gifts is a very important piece in the Offshore Compliance puzzle. It doesnt matter if the gift is to a US. This event triggers the requirement to file form 3520.

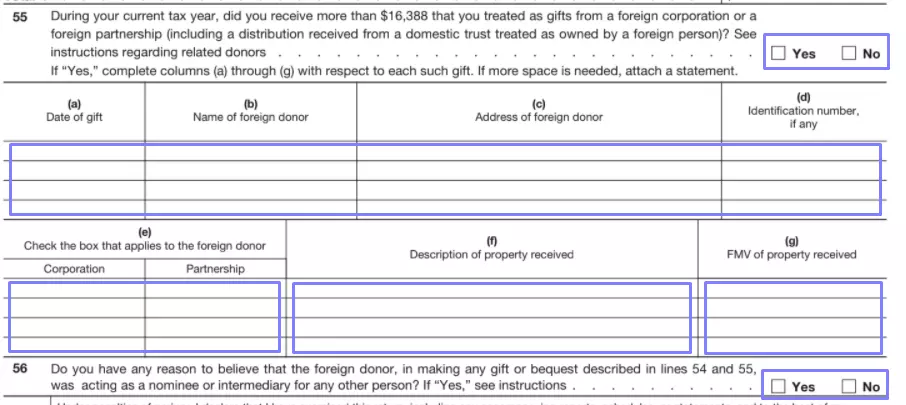

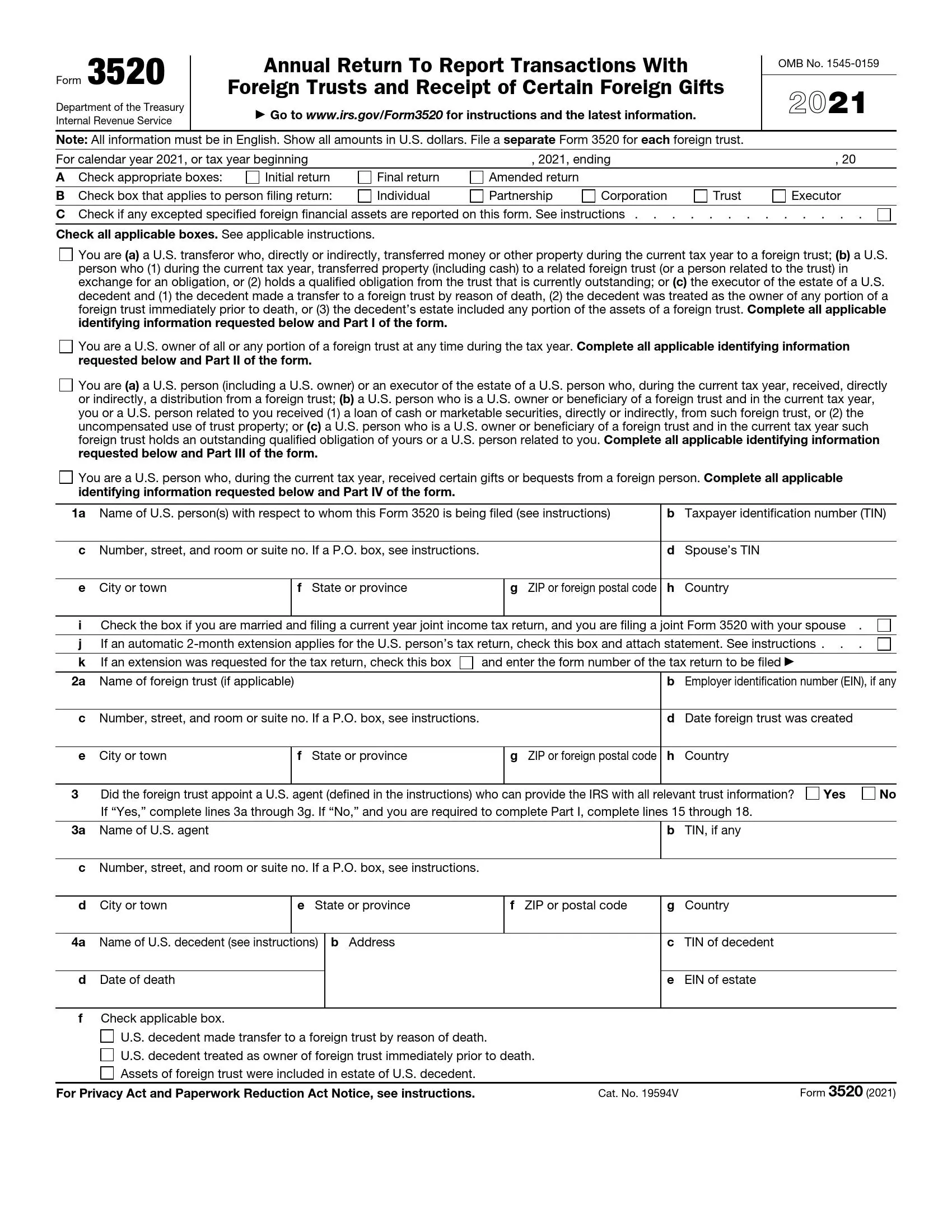

Gifts from Foreign Persons Gifts From Foreign Persons. This value is adjusted. Taxpayers report transactions with certain foreign trusts ownership of foreign trusts and receipts of large gifts from foreign entities.

However if after reading the instructions below. A married couple may not file a joint gift tax return. Person is required to report the receipt of gifts from a nonresident or foreign estate only if the total amount of gifts from that nonresident or foreign estate is more than.

Because the gift came from your dad despite how he needed help from others to facilitate the transfer. Tax on Gift with No Income. The donor is required to file a gift tax returns when then annual gift made to any person during the year does not exceed 15000.

In addition gifts from foreign corporations or partnerships are subject. The tax applies whether or not the donor. The value of the gift or bequest received from a nonresident alien or a foreign estatewhich includes gifts or bequests received from foreign persons related to the.

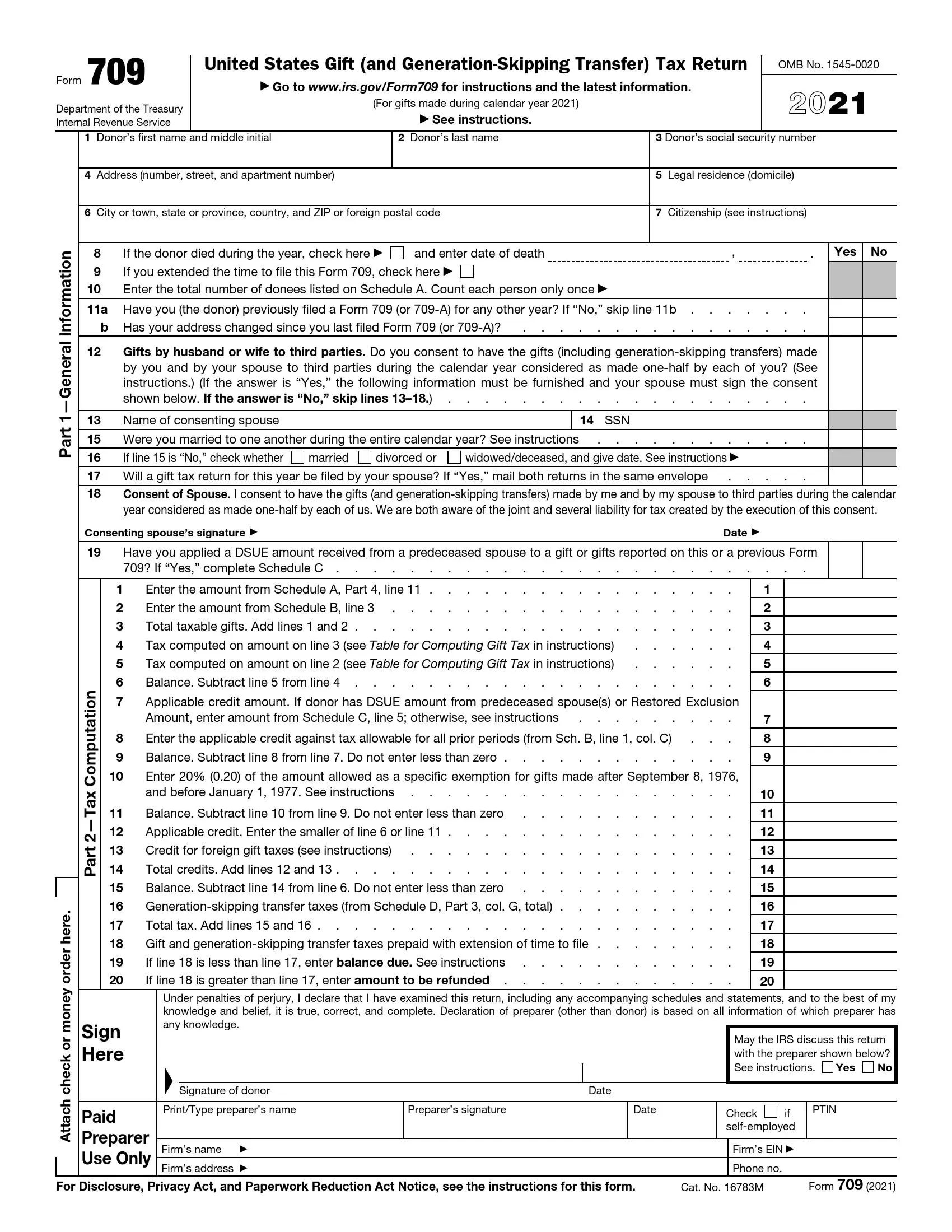

About Form 3520-A Annual. Person receives a gift. United States Gift and Generation-Skipping Transfer Tax Return.

Instructions for Form 1040 Form W-9. Foreign Gift Tax the IRS. Person who received foreign gifts of money or other property you may need to report these gifts on Form 3520 Annual Return to Report Transactions with Foreign Trusts and Receipt of Certain Foreign Gifts.

If the value of those gifts to any one person exceeds 15000 you need to file. Examples of Foreign Gift Reporting Tax Example 1. Austria Denmark France Germany Japan and the United Kingdom.

Persons who receive gifts from a non-resident alien or foreign estate totalling more than. Reg 252501-1 a nonresident alien donor is subject to gift tax on transfers of real and tangible property situated in the United States. If you are a US.

Form 3520 is an informational return in which US. Persons who must file this form. Learn the thresholds of reporting a foreign gift when you need to file a form 3520 and more information on reporting foreign gifts from our international tax attorneys.

Form 3520 is technically referred to as the Annual Return To Report Transactions With Foreign Trusts and Receipt of Certain Foreign Gifts. It is the annual limit for the exclusion of gift tax. For example an American expat receives a.

According to IRC. The reporting rules for overseas gifts to the IRS is big business for the Internal Revenue Service. For gifting purposes there are three key categories of US.

Form 3520 Filing Requirements. Further you must report foreign gifts from foreign corporations or foreign partnerships of more than 16649 as of tax year 2020 on Form 3520. Tax ramifications on the initial receipt of a gift from a.

Person gives a gift that exceeds the annual exclusion amount they typically must file a Form 709 unless an exception or exclusion appliesThe rules are different when the US. Specifically the receipt of a foreign gift of over 100000 triggers a requirement to file a Form 3520 Annual Return to Report Transactions with Foreign Trusts and Receipt of.

How To Fill Out A Fafsa Without A Tax Return H R Block

Irs Form 3520 Fill Out Printable Pdf Forms Online

Complying With New Schedules K 2 And K 3

Irs Form 709 Fill Out Printable Pdf Forms Online

How The Us Gift Tax Applies To Foreign Nationals Bny Mellon Wealth Management

Completing Form 1040 And The Foreign Earned Income Tax Worksheet

Gifting To Us Persons A Guide For Foreign Nationals And Us Donees Bny Mellon Wealth Management

Irs Form 3520 Fill Out Printable Pdf Forms Online

Gifts From Foreign Persons New Irs Requirements 2021

/WheretoGetaMoneyOrder-7e5ce5ccbac84b39aaa04b5aba66a961.jpg)

Form 709 United States Gift And Generation Skipping Transfer Tax Return

Gifting To Us Persons A Guide For Foreign Nationals And Us Donees Bny Mellon Wealth Management

Gifting Money To Family Members Everything You Need To Know

2 Fam 960 Solicitation And Or Acceptance Of Gifts By The Department Of State

Gifts From Foreign Persons New Irs Requirements 2021

Completing Form 1040 And The Foreign Earned Income Tax Worksheet

Foreign Gifts When Do You Have To Report Them Freeman Law

/WheretoGetaMoneyOrder-7e5ce5ccbac84b39aaa04b5aba66a961.jpg)

Form 709 United States Gift And Generation Skipping Transfer Tax Return

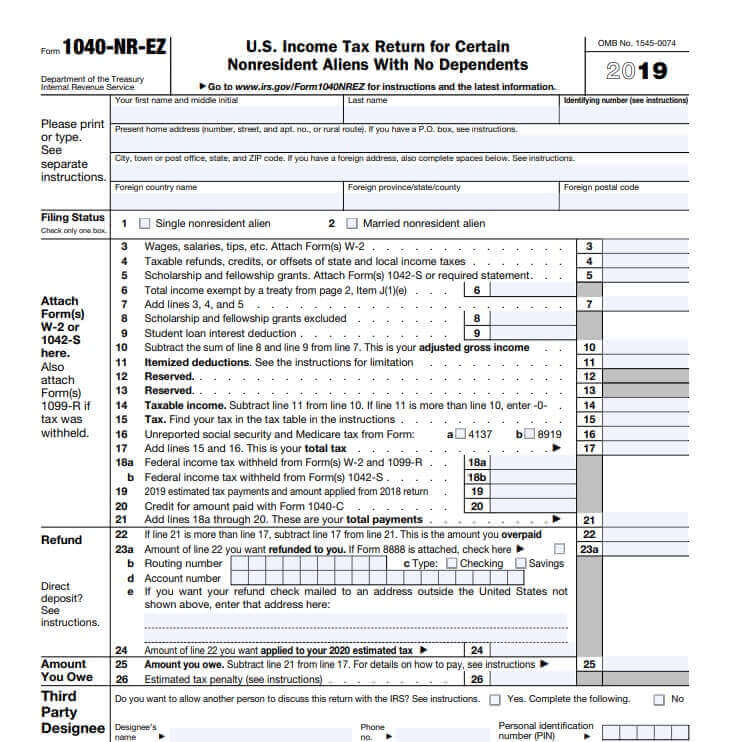

Us Tax For Nonresidents Explained What You Need To Know

:max_bytes(150000):strip_icc()/ScreenShot2020-02-03at1.41.37PM-322605a2b23a49598d9cdf9faee0a97a.png)

Form 706 United States Estate And Generation Skipping Transfer Tax Return Definition